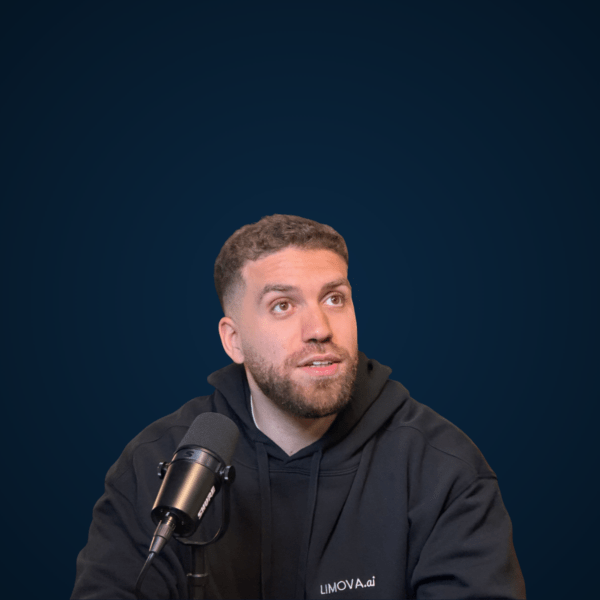

Inside 199 Ventures: How Gaultier Brun is shaping a Marketing-First VC Fund

Gaultier Brun has spent his twenties between hypergrowth startups, international VC and early personal bets, including a ticket in a future unicorn. Today, at 199 Ventures, he pushes a bold thesis : investing early in founders who understand that marketing is not a layer of paint but a strategic engine. At 27, he helps craft one of the few French funds where storytelling, acquisition and product distribution sit at the center of the investment model.